What is Bank Cheque?

Types of Bank Cheque, Functions, and How to Use

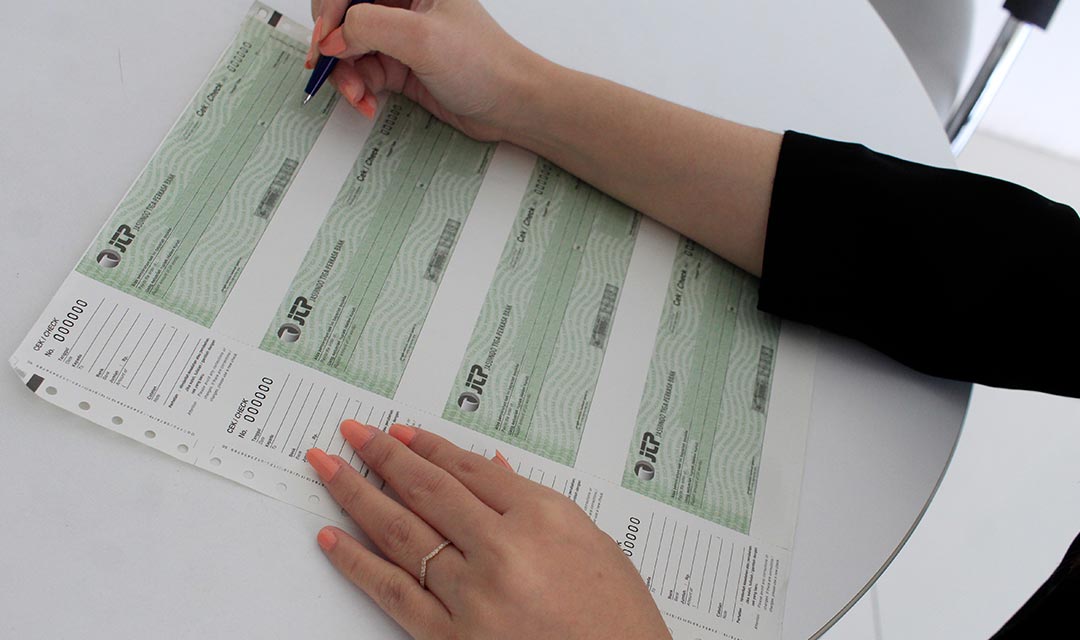

Bank cheque are a financial instrument commonly used in business and personal transactions. Along with technological developments, bank checks are still relevant even though there are many digital payment alternatives. Check out further discussion about bank cheque below!

Types of Bank Cheque

There are various types of bank cheque that apply in Indonesia, including:

1. Cheque the Performance (Aan Tonder)

A bearer cheque or what is known as “Aan Tonder” is a type of cheque that can be cashed by anyone who gives the cheque to the bank. This means that this cheque is not tied to a specific name. Cheque holders do not need to prove their identity or status to get paid. Bearer Cheque are usually used in situations where payment must be made in cash and without additional conditions.

2. Cross Cheque

Crossed cheque or crossed cheque regulate who or the financial institution has the right to receive payment for the check by marking the check with a cross. There are two types of cross cheque, namely special cross cheque and general cross cheque.

A special cross cheque is a cheque that is intended for disbursement only to a particular bank whose name is written under the cross on the cheque. This means that this cheque can only be cashed at the bank whose name has been determined, and cannot be cashed in cash at another bank or elsewhere.

A general cross cheque is a check that also has a cross above or around the cheque owner’s signature, but without the specific name of the bank below the cross. This cheque can be cashed at any bank, it is not tied to a particular bank like a special cross cheque. The recipient of the cheque can exchange it at any bank without certain restrictions.

3. Cheque on behalf of (Aan Order)

A cheque in the name or order is a type of cheque that can only be cashed by the party whose name is specifically stated on the cheque. If the cheque is written in “A” name, then only “A” can exchange it at the bank. A cheque in the name provides additional protection for payment security because only the person to whom it is addressed can receive the payment.

4. Cheque calculations

Calculation cheque are a type of bank cheque whose payment is limited, only used as a transfer. This means that cheque calculations can only be used to move funds between accounts, not for cash withdrawals. Payment restrictions are made by writing a statement in an italic direction on the front of the cheque, such as “to be placed in an account” or similar information indicating the purpose of the transfer.

Bank Cheque Function

Bank cheque have several important functions in the world of finance, including:

1. Flexible payment alternatives

Although debit and credit card transactions are increasingly common, bank cheque remain an essential alternative, especially in situations where the payee does not have access to or preference for electronic transactions. Bank cheque provide additional security because they are not directly tied to a bank account, making them a reliable option in some cases.

2. Proof of payment

Bank cheque also serve as valid proof of payment. Cheque that have been cashed by the bank become proof of transactions that can be used for accounting and audit purposes.

3. Easy fund disbursement facility

Another main function of bank cheque is to make it easier to disburse funds. When someone receives a cheque as payment, they can easily exchange it for cash at the bank or deposit it in their account. This provides flexibility in financial management, especially for those who do not have a bank account or do not have access to electronic banking services.

How to Use Bank Cheque

To use bank cheques correctly, follow these steps.

1. Fill out the cheque correctly

Make sure to fill in the information on the cheque clearly and accurately, including the amount of money to be transferred and the name of the recipient of the cheque.

2. Signature

Sign the cheque in the space provided in clear ink. This signature is proof that you have issued the check.

3. Hand it over to the recipient

Give the cheque to the intended recipient, making sure to give the correct type of cheque.

4. Cash it in the bank

The recipient of the cheque can exchange it at the bank in accordance with applicable procedures. Make sure the check is not past its due date.

Jasuindo: Bank Cheque Printing Solution

To make the process of printing bank cheque easier, you can take advantage of services from Jasuindo. We offer cheque printing solutions that can be tailored to your needs. Starting from watermarks, logos, serial numbers, account numbers, bank numbers, and security features that have been carefully considered to create bank cheque that suit the image and needs of your institution.

With experience in the security printing industry, we are committed to providing high quality cheque printing services and adding value to your institution.